Are Rolex watch prices still on the decline?

Indeed, some Rolex models continue to see secondary price declines, primarily because of reduced demand at retail. However, it's important to note that the majority of Steel Sports Rolex Models are maintaining their value well. We anticipate that these particular watches won't dip below their retail prices anytime soon.

Rolex GMT Master II

The GMT Master II stands out as one of Rolex’s most sought-after sports models, often commanding lengthy waiting lists, averaging around three years for a steel variant. Since the introduction of the Black and Blue Bezel GMT, fondly dubbed ‘The Batman’, in 2016, this range has experienced a notable surge in demand, resulting in increased premiums. Among the GMT Master II lineup, we anticipate that the following references will continue to carry premiums above their list prices for the foreseeable future, encompassing both Oyster and Jubilee variants:

- ‘Batman / Batgirl’ reference: 126710BLNR

- ‘Pepsi’ reference: 126710BLRO

- ‘Sprite’ reference: 126720VTNR

- ‘Bruce Wayne’ reference: 126710GRNR

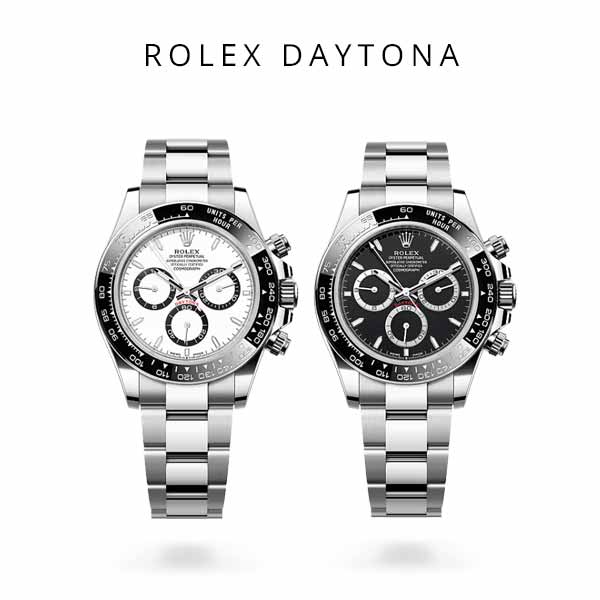

Rolex Daytona

Rolex’s most coveted timepiece undoubtedly remains the Daytona. Its evolution, notably with the introduction of a ceramic bezel in 2016, initiated what we now recognize as the infamous ‘waitlist’. Demand for this iconic watch soared, with average wait times initially hovering around 3-6 months. Fast forward to today, and prospective buyers face an astonishing wait of approximately 10-15 years, assuming they’re fortunate enough to secure a spot on a waiting list in the first place.

Similar to the GMT Master II, the most sought-after Daytona models are all in steel variants, including the ‘Panda & Reverse Panda’ reference: 126500LN.

Rolex Submariner

The Rolex Submariner reigns as the world’s most coveted steel sports model. Although more accessible at retail through authorized dealers, steel variants of these watches still command a modest premium for buyers seeking one within a two-year timeframe. For those keen on preserving value, we suggest considering the following models:

- ‘Submariner Date’ reference: 126610LN

- ‘Submariner Non-Date’ reference: 124060LN

- ‘Kermit / Starbucks’ reference: 126610LV

Rolex Sky-Dweller

The Rolex Sky-Dweller stands out as one of the most intricate timepieces ever crafted by Rolex. Securing a steel variant with either a blue or green dial demands a notable premium. Prospective buyers should brace themselves for a potential wait of around three years for the opportunity to acquire one. For those determined to pursue this horological gem, the model number to keep in mind is:

Blue/Green dial – reference: 336934

So what should you do?

While it’s unlikely that any of these Rolex models will dip below retail price, our guiding principle remains: invest in a timepiece you truly enjoy. While the idea of a watch retaining its value is appealing, fixating solely on this aspect could lead to dissatisfaction. It’s crucial to choose a watch that resonates with you, as focusing solely on its value might result in regret and potential financial loss if you decide to sell it later on.

For more help on this subject, check out our Article: Is a Rolex Watch a Good Short-Term Investment in 2024?

Are watches a good investment?

Depending on the brand you choose, some watches can be classified as a ‘good’ investment. However, like all investments, there are several factors to consider, such as the potential depreciation in the price of the purchased watch.

Here are some rules to adhere to when considering watch investments:

Rule No.1 - Stick to Your Budget

The primary rule when investing in watches is to adhere to your budget and try not to exceed it. The more you spend, the higher the risk of financial loss.

If you can comfortably afford to invest £10,000, limit your spending to that amount. If stretching your budget could cause financial strain, reconsider your investment strategy.

It’s advisable to reserve the funds for the desired watch and wait for availability rather than financing the purchase and accruing additional costs through annual percentage rates (APRs).

Rule No.2 - Select the Right Brand

Not all watch brands are equal. While there exists a certain level of snobbery surrounding watch brands, it’s an undisputed fact that some brands are more collectible and sought after than others.

This doesn’t necessarily make them superior, but it does increase their investment potential. Among the top brands offering investment potential are Rolex, Audemars Piguet, and Patek Philippe.

Rule No.3 - Choose the Right Model

After determining the brand you prefer, it’s crucial to select a model that has a high likelihood of retaining or increasing its value. However, this decision is heavily influenced by market trends. What’s popular today may not hold the same appeal in six months or a year.

As of 2024, the most sought-after models include the Rolex Submariner, GMT Master 2, and Daytona; the Audemars Piguet Royal Oak; and the Patek Philippe Nautilus and Aquanaut.

Rule No.4 - Choose Your Desired Specifications

Within each model, various characteristics differentiate one watch from another. These include the type of metal used, which can range from steel to gold or platinum, as well as the bracelet variations, such as different styles or materials like rubber.

Most importantly, consider the dial variations. When contemplating a watch purchase with future investment potential, pay close attention to the dial, as it is the most unique and sought-after feature.

Popular dials often feature bold colors or rare materials, setting them apart from more conventional counterparts. These distinctive characteristics make them highly desirable to collectors and enthusiasts alike.

Rule No.5 - Always Purchase Something You Like

While it may seem obvious, many individuals find themselves swept up in the allure of luxury watches and make impulsive purchases without considering their personal taste. Investing in a watch that you dislike or find uncomfortable to wear can lead to disappointment and financial loss in the long run.

A final thought

Like all investments, the value of watches can fluctuate, sometimes rising and sometimes falling. It’s essential to understand that while watches can be viewed as long-term investments, conducting thorough research is crucial when purchasing luxury items. Ensuring the legitimacy, authenticity, and solid provenance of the items is advised.

As a watch collector and enthusiast, I’ve come to accept that the value of my collection might not equate to half of what I initially invested in it, and that’s perfectly fine with me. Each watch in my collection holds sentimental value, telling its own unique story of why I acquired it. To me, watches transcend mere investment—they represent a beloved hobby that I share with friends and fellow enthusiasts worldwide.

To help retain your watches value check out our article: 7 tips to retain the value of your luxury watch

Are the Rolex flipping days officially over?

Absolutely, you heard it correctly – the era of flipping Rolex watches is winding down, especially for hot-ticket items like the Steel Submariner Date and Non-Date. Dealers are snatching them up at nearly the recommended retail price (RRP). However, don't pack up your investment dreams just yet; there are still opportunities in the Rolex game. The key? Knowing what to buy and gearing up for a bit of a rollercoaster ride.

The Historical Frenzy

So, remember the crazy markups on used Rolex watches? It all started back in 2016 with the ceramic Daytona – that one watch that made everyone lose their minds. Suddenly, there were waiting lists longer than a blockbuster movie marathon, averaging 1-2 years. And boom, that turned second-hand models into gold mines.

But wait, it didn’t stop at the Daytona. The hype trickled down to other cool watches like the Submariner and GMT, making all-steel sports models like rare Pokémon cards for new collectors – impossible to get.

The Now Scene

Fast forward to today, after Rolex jacked up prices more times than we’ve lost our keys. Now, some “hard to get” sports models, like the non-date and date Submariners, and bimetal GMTs, are playing price tag catch-up with their brand-new buddies in the store. Also, other brands like Tudor are doing a 180, turning once-exclusive watches into online shopping bin regulars.

It’s a mixed bag for collectors. On one hand, those Rolex dreams are closer to reality at retail. On the flip side (pun intended), the old hard-to-get Rolex gang is losing some of its cool factor. People are ditching their preowned watches like it’s a flash mob, causing a flood of supply and, you guessed it, a dip in prices.

Dealers' Dilemma: Cheap Thrills

Dealers are in on the action too. They’re snagging watches at or just below the retail price because, let’s face it, there’s a watch flood out there. Even newbies like the Rolex GMT Master 2 – 126713GRNR (aka “The Zombie”) took a nosedive from £30,000 to around £16,000 in just six months. Dealers are playing it safe, avoiding the hype train to keep their wallets from catching fire.

Collecting Wisdom: Don't Rush, Don't Regret

So, what’s our advice in this watch rollercoaster? Stick to the classics: buy a watch you genuinely want to keep for the long haul. Forget the quick cash dreams; think about whether you can stand by that timepiece for 2-3 years or more. If commitment issues kick in during the purchase, take a step back. Patience pays off, and there’s always another watch waiting to steal your heart.

Investing in Style: The Gamble Game

Are watches still investment material? Sort of. But don’t go blowing your paycheck on the latest and greatest. That new model will age faster than last year’s tech. Real “investment” potential lies in discontinued models with a history – the ones not making the rounds anymore. They might fetch a higher price due to rarity, condition, and people wanting them bad. But let’s be real, it’s more of a gamble now than the old Rolex flipping sure thing. Do your homework and be ready for a wild ride.

Rolex Market Update: Buy, Sell, or Invest? Our Insight.

You might be wondering what's happening in the watch market, and we're here to provide you with the latest market update.

After reaching historic highs in February 2022, we are currently witnessing a significant dip in the prices of preowned watches. While this may prompt some to rush to their safety deposit boxes and consider selling their watches on the open market, it has also created a fantastic opportunity for those who previously saw their dream watches reach astronomical prices, making them unattainable. Now, these watches appear to be more affordable.

So, what's causing this sharp decline?

The cost of living crisis, which has affected the prices of essential goods like food, fuel, and raw materials, combined with the ongoing high levels of inflation, has created the perfect storm for reduced buying activity in the luxury sector. To be clear, people are still buying watches, but they are primarily serious collectors who now see an opportunity to purchase their desired watches at prices at least 25% lower than the highs we witnessed last year.

Is the market currently at its lowest point?

At present, the market seems to have decreased by at least 25%, bringing preowned watch prices for stainless steel models back to what we might consider “normal” levels. By “normal,” we mean prices that reflect a sustainable increase, not below retail.

So, what should you do? Should you buy or sell?

Your decision depends on your current situation. If you bought a watch with the intention of making a quick profit, I must say that this is not an ideal time for you. You may want to consider holding onto your watch or, at worst, selling it promptly.

However, if you are a genuine collector looking to purchase a high-demand watch at a fair market value, there has never been a better time to find the watch you’ve always desired.

What does the future hold for watch investing?

As a watch enthusiast and collector, I would advise against viewing watches solely as commodities to invest in. Instead, I recommend buying a watch that you truly enjoy and love. I predict that the market will continue to grow, albeit not reaching the highs of 2022.

We may see annual growth rates of 5-7% for stainless steel high-demand pieces and around 2-3% for bi-metal pieces. As for solid gold and other precious metal watches, it’s possible that their prices may dip below retail for the foreseeable future.

7 tips to retain the value of your Rolex watch

I know what you are thinking, ‘Rolex watches always retain their value’, and that statement is indeed true, but are there things that could reduce the value of your watch? Yes and here are seven tips to help you retain the value.

Tip 1: Wear your watch frequently

Now, this might come as a surprise but not wearing your watch can affect the movement over time. Think of it like a car sitting on your driveway for 2 months. On the outside, it will look fine but under the bonnet, the lack of mobility will inevitably lead to parts seizing up or failing. We would recommend cycling your watch collection to ensure all your watches get plenty of wrist time to keep the movement active.

Tip 2: Condition is key

While wearing your watch as much as possible is always good, it is always worth trying to avoid potential hazards which could potentially scratch, dent, or break components of your watch. The most common areas for these occurrences are the sapphire crystal face, the side of the lugs, and the clasp. These areas of your watch are normally close to table edges, door handles, and sometimes concrete floors. And while it is not the end of the world if you do scratch your watch, it will cost up to £200 to get it polished and back to looking new again.

We would recommend keeping one of our Clam Single Watch Travel Cases with you just in case you are doing anything that might cause you to damage your watch or if you need to secure your watch while in storage.

Tip 3: Keep everything that came with the watch

This might seem like an obvious tip, but you will be surprised at how many people throw away the box, receipt, and even the paperwork for the watch. But if a secondary market dealer was to tell you that the box, papers, and purchase receipt could be worth 10-20% of the value of the watch, you would defiantly think differently!

This is why we would recommend you keep hold of everything that comes with your watch which would normally consist of:

- The Watch (Obviously)

- Green Presentation Box (with cushion)

- Cream outer Box

- White sleeve with sticker

- White hangtag

- Green certified tag

- All links (If any are removed from the watch)

- Bezel protector (Sometimes these are excluded)

- Rolex manual

- The warranty card with the Rolex green wallet

- Original Purchase Receipt

Tip 4: Keep it original

Another tip that might be obvious to the seasoned collector but keeping your watch original is vital to value retention.

When we say ‘original’ a secondary market dealer would say ‘factory’. This would mean that all parts of the watch including the bracelet, dial, and hands remain with the watch even if it goes in for a service. Rolex has been known to replace dials, bezel inserts, and original bracelets on vintage models when they come in for a service. While it is nice to have something new and, in most cases, improved on your watch after a service, collectors go mad for original parts even if they are heavily worn.

So, if the watch does go in for a service, be sure to keep all original parts for your watch. This will increase the value by a possible 30% on certain models.

Tip 5: Stay away from aftermarket

Very similar to tip number 4, we would recommend staying clear of anything that is considered aftermarket. This includes adding gems to the watch by drilling holes into the metal itself. Other things we would recommend staying clear from are after-market bezels or dials. While these are not permanent, they are unnecessary and will require you to keep hold of the original parts later.

Tip 6: Beware of water damage

One of the costliest repairs for any Rolex watch is the frequent mistake to not screw the crown down properly before entering the water. I have unfortunately seen many watches that have had water creep into the movement and to put it simply, water and oil do not mix at all. This will lead to an extensive repair cost of around 7-10% of the value of the watch.

Tip 7: Don’t over-polish your watch!

As mentioned in tip number 2, a professional polish can cost between £100-£200 (depending on the metal), and frequent polish can create a domed mirror effect instead of a flat mirror effect. This is one of the few ways you can tell a watch has been over-polished or not polished correctly.

Another unfortunate outcome of amateur polishing is rounding the edges of the lugs. Some secondary market dealers would refer to the watch as being ‘sharp’. This generally means that the edges of the watch are sharp and have either not been polished or had a professional polish.

It’s hard to say if polishing affects the value as some buyers like their watch looking new, however, depending on the model and age, we would advise asking a second opinion before polishing your watch.

In conclusion

The general rule of thumb is to enjoy your watch but be mindful that keeping it in great condition will help you reduce any potential costs later on. After all, no one likes unexpected services or costly repair bills so by following these 7 tips you should be able to keep your watch in top condition for yourself to enjoy or move on to the next potential owner.

5 heirloom watches to keep in the family

We have all been there, standing at the shop window looking at your dream watch and thinking of the 100 excuses to tell your partner why you bought a watch the same value as a second hand car. Well to add to the excuses here are 5 heirloom watches to keep within the family.

Rolex Submariner

The Timeless Classic

The Rolex Submariner has always been seen as the timeless classic of the Rolex collection. Originally created for divers to keep accurate time on their remaining oxygen supplies, the submariner has been transformed from a divers tool watch to day-to-day wearer worn by business professionals and general hobbyists.

One thing we like most about the submariner is how versitile the watch is within its category. It can be worn at almost any occasion, from a building site to formal dinner, and it can take alot knocks and scrapes along the way without affecting its ability to keep accurate time.

While we are fans of the all steel version of this watch if purchased in steel or in precious metal this watch ticks all the boxes for a great family heirloom.

Images used from www.rolex.com

Images used from www.tudorwatch.com

Tudor Black Bay 58

The Hidden Gem

If you were looking at the submariner and you said to yourself, i cant justify spending £6300. Thenwe think we have found the perfect substitute.

Behold the glorious Tudor Black Bay 58.

If you are unfamiliar with tudor here is a quick recap of the brand. Tudor watch company was founded in 1926 by none other than the founder of Rolex, Hans Wilsdorf.

Wilsdorf created the sister brand to offer a cheaper solution to Rolex while maintaining high quality watchmaking and materials. Recently, Tudor have been making big moves in the watch world, and collectors are seeing Tudor as the go-to brand for affordable luxury.

And they are not wrong! The Tudor Black Bay 58 is probably the best value for money watch on the market today, With all the elements of the non-date submariner this Tudor watch is also a fraction of the price of its older brother at just £2760.

With a 39mm case, Unidirectional rotatable bezel , domed sapphire cystal, and waterproofness up to 200m this watch is as good as the submariner, just without the Rolex badge.

Omega Seamaster Diver 300M

The Bond Watch

While you might have seen this watch on the movie screens worn by such Bond actors as Daniel Craig & Piers Brosnan, you would have probably bypassed this watch when visiting your local Authorised Dealer.

The Omega Seamaster Diver 300M is a beautiful and versatile watch similar to the Rolex Submariner. With the ability to sip under a shirt and dive to 300m it is needless to say why this watch is featured in all the Bond Movies. Unlike the Rolex Submariner, this watch is obtainable from shop windows and no 2 year waiting lists, which is a big plus along with the more reasonable price tag of £4170. And if your not a fan of black, no worries as comes in blue as well as bimetal varients.

So if your looking for something abit more available, good looking, and a beautiful watch to pass down the generations. Look no further than the Seamaster Diver.

Images used from www.omegawatches.com

Images used from www.audemarspiguet.com

Audemars Piguet Royal Oak

Rugged, while elegant

Another fan favourite for collectors far and wide is the Audemars Piguet Royal Oak.

While there are many variants of the Royal Oak, the all-steel Ref. #15500ST.OO.1220ST.01 is the hot ticket right now.

Sporting a 41mm case , water-resistance of 50m, and probably the most beautiful bracelet on the market, this watch is stunning and this could also be said regarding the retail price. At £19,900 this watch is one of the most expensive on this list but unfortunately it doesnt end there. If you can find one in the shops selling for £19,900 that would be considered a steal…yes these watches are known to fetch as much as £27,000. which is comparible to a preowned, 2014 solid gold, submariner. Plus you will still have £2,000 change.

But if you do have a spare £27,000 tucked behind the sofa cushions, you probably wouldn’t go far wrong with purchasing this watch, as long as you keep it within the family for the foreseeable future.

Patek Phillippe Aquanaut

The 'watch' of watches

If you are looking for the watch that will be admired and adored by collectors and every generation of your family, this is the watch to acquire.

The Patek Phillipe Aquanaut is the beauiful introduction into the Patek sports line. With beautiful looks and excellent provenance this watch sports a 40mm case, self-winding movement, date function, and gorgeous sapphire crystal case back to view the Caliber 324 S movement.

While this watch retails at £15,110 you will be lucky to find one in the high twenties. With a 2018 model of this watch fetching £35,950 on the secondary market, its needless to say this watch is highly desirable.

With the Patek Phillipe famous slogan:

‘You never actually own a Patek Philippe. You merely look after it for the next generation.’

It is understandable why this awesome watch has made our list.

Images used from www.patek.com

OVERVIEW

Your Watch Story

While these watches are our top 5 watches for passing down to generations to come, there are definitely more than just 5 watches that could be fantasic heirlooms.

Tell us what watches you are planning to give to your children and your purchase decisions around the watch. We would love to hear your stories.