It’s January 2nd, 2026. We’re barely 24 hours into Rolex’s latest round of price increases, and after reviewing the Rolex 2026 prices for flagship models like the Submariner, GMT-Master II, and Daytona, one thing is clear: these watches are becoming increasingly hard to justify for the enthusiast.

At today’s Rolex 2026 prices, many models are edging toward a point where there’s little to no intrinsic “value” left beyond the name on the dial. Let’s break down what’s changed—and what it could mean for the Rolex landscape in 2026.

What Increases Have We Seen?

Across the highly desirable steel sports range, prices have risen by an average of around 5%, while gold models have jumped closer to 8%, largely driven by gold’s strong performance throughout 2025.

While these increases slightly outpace reported UK inflation, inflation isn’t the real issue. The bigger concern is the compound effect of repeated price hikes over the past decade.

To put this into perspective:

In 2015, I purchased my first Rolex Submariner Date (116610LN) brand new for approximately £5,600. At the time, it was widely regarded as excellent value—and the steel sports hype cycle was only just beginning.

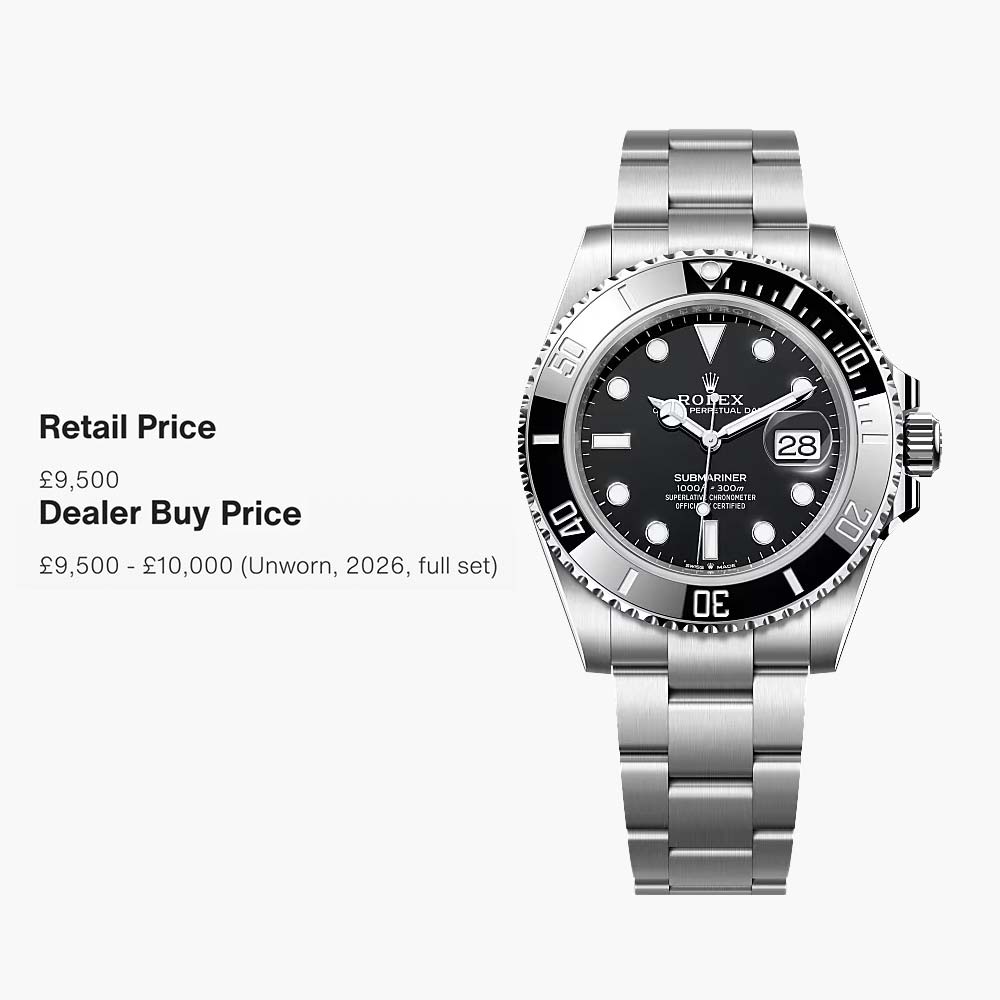

Fast forward to today. Under the current Rolex 2026 prices, the updated Submariner now retails at £9,500, while the green bezel 126610LV comes in at £9,950, sitting uncomfortably close to the five-figure mark for a steel watch.

Why Is This Significant?

Steel sports Rolex models breaking the £10,000 barrier is psychologically huge. For many collectors, £10k represents a hard ceiling—an amount traditionally reserved for precious-metal watches, not plain steel.

Once a watch crosses into five-figure territory, the buyer pool shrinks dramatically. The latest Rolex 2026 price structure risks pricing out a large portion of genuine enthusiasts.

What’s Next for Steel Sports Rolex?

With Submariners and GMT-Master IIs now flirting with—or exceeding—£10,000 at current Rolex 2026 prices, many collectors may simply decline “the call” from their authorised dealer.

Why? Because retail prices are now dangerously close to secondary-market values, which historically sat at a 20%+ premium over RRP.

As a result, we predict that models like the Submariner Date and No-Date could soon become window watches—available for walk-in purchase without a waiting list.

The GMT-Master II range may tell a slightly different story. The black and grey bezel 126710GRNR is likely to be the least in demand, with estimated wait times falling to around six months. However, coloured bezel models—the Batman, Batgirl, and Sprite—should retain longer waits of roughly two years.

The steel Daytona is expected to remain largely unaffected. With secondary premiums still hovering around 80%, demand remains extremely strong. That said, two-tone Daytona models could soon become non-waitlist pieces, as Rolex 2026 prices push them toward the £20,000 mark.

What About the Secondary Market?

Despite widespread increases across the Rolex catalogue, we don’t expect a dramatic shift in secondary prices.

However, dealer buy prices are likely to soften. As fewer retail buyers step in at current Rolex 2026 prices, supply to the secondary market may tighten—not because demand is rising, but because fewer watches are being purchased at retail in the first place.

Our Final thoughts

As watch enthusiasts and collectors, our advice is simple: only buy a watch you genuinely want to own.

The era of easy speculation is over. Gone are the days of buying a watch purely to ride the wave of hype or rely on annual price increases to do the heavy lifting. We’re coming almost full circle to 2016, when a Rolex was seen as a personal milestone—an achievement—rather than a short-term investment.

Back then, only a handful of models, most notably the steel Daytona, commanded a meaningful premium. Everything else was bought to be worn, enjoyed, and celebrated.

We believe we’re entering that era once again—and for true enthusiasts, that might be the healthiest reset the market has seen in years.